A trust is a legal document that provides for a trustee to hold or distribute your assets both during your lifetime and after your death, and allows for the easy transfer of assets to friends and family without having to go through the probate process.

As a Maryland estate planning lawyer, I am here to help you better understand the different aspects of your estate plan and can assist you in determining whether a Trust is suitable for you. Reach out to DK Rus to get started with planning for the future today.

Putting Your Assets in a Trust

A Trust is a fiduciary relationship where one party, the trustor, gives another party, the trustee, the right to hold title to assets or property for the benefit of a named beneficiary. Trusts legally protect the trustor’s assets and ensure the proper distribution of those assets according to their wishes. In a Living Trust, assets must be transferred into the Trust in order for it to be effective, but once it goes into effect, a Living Trust can provide for the handling of those assets both during your lifetime and after your death.

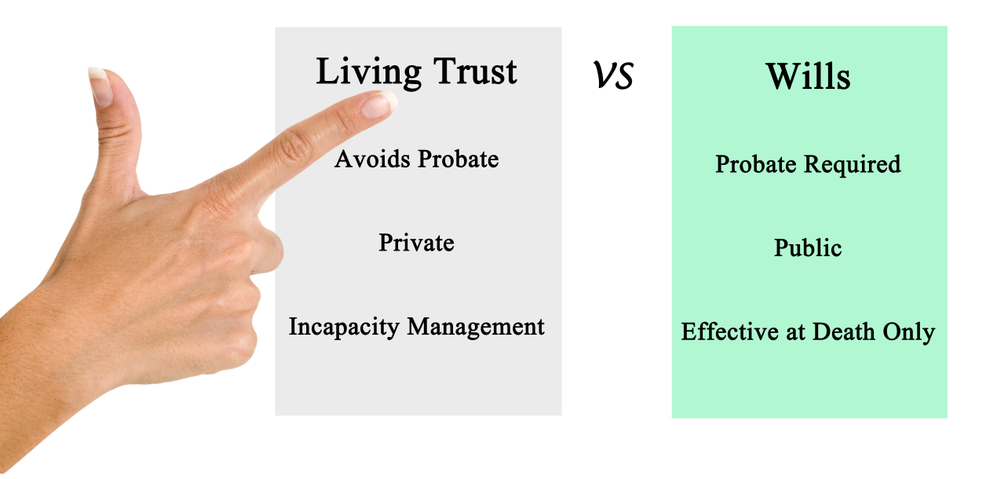

How a Trust is Different from a Will

For some, a revocable living trust can be more effective than a will. A trust allows your assets to pass on to your heirs without having to go through probate—the process by which a court oversees the distribution of your assets.

Avoiding probate can result in significant savings if you have a large estate or if you own property in more than one state, where multiple probate proceedings may be required. Also, unlike the probate process, settling a revocable living trust is private; another advantage if you don’t want the details involving the distribution of your assets to be public knowledge.

The Permanence of an Irrevocable Trust

Many people don’t realize that the proceeds from life insurance policies that they own at death may be included in their estate for estate tax purposes. An irrevocable life insurance trust (“ILIT”), ensures that insurance proceeds paid to the trust will not be included in the estate of the insured. In addition, the ILIT can be structured so that the trust will provide benefits to the insured’s surviving spouse without inclusion in the surviving spouse’s estate.

An irrevocable trust is named as such because it cannot be rescinded, amended, or modified after it is created. In other words, once the grantor contributes property to the trust, he or she cannot later reclaim ownership of the property or change the terms of the trust.

Donating Your Assets to a Charitable Organization

A Charitable Remainder Trust is an arrangement under which property or money is donated to a charity, but the donor continues to use the property and/or receive income from it while living. The beneficiaries of the trust (whether the donor or someone else) receive the income and the charity receives the principal after a specified period of time. This is particularly useful when the donor has appreciated assets (i.e., assets in which the present value is greater than the basis, such that the sale of the asset would result in a hefty capital gains tax).

In establishing a Charitable Remainder Trust, the donor can avoid the capital gains tax on the donated assets and also get an income tax deduction. In addition, the asset is removed from the estate, reducing estate taxes. Under the right circumstances, this plan can increase income, reduce taxes, and provide support for the charity or organization(s) of your choice.

Special Needs Trusts for Beneficiaries with Disabilities

A special or supplemental needs trust, is used to provide for the needs of a disabled person, without disqualifying him or her from benefits received from government programs such as Social Security and Medicaid. Such trusts allow a disabled beneficiary to receive gifts, lawsuit settlements, or other funds in a manner such that the funds will not be considered to belong to the beneficiary in determining eligibility for public benefits. These trusts are not intended to provide basic support, but instead to pay for comforts and extras that are not available from public assistance.

These trusts typically pay for things like:

- Education

- Recreation

- Travel

- Clothing

- Counseling

- Medical attention

…beyond that provided by governmental programs. The trustee can also use trust funds for food and shelter if the trustee decides doing so is in the beneficiary’s best interest, despite a possible loss or reduction in public assistance.

Supplemental needs trusts can be created by a parent or other family member, or may be set up in a Will as a way for an individual to leave assets to a disabled relative. Under certain circumstances, a disabled individual may also be able to create the trust themselves, with proceeds from a personal injury award or settlement.

Get Started with a FREE Consultation from DK Rus Law

Whether you're ready to begin estate planning or need legal business advice in Maryland, DK Rus can help.

Schedule your complimentary legal consultation today: